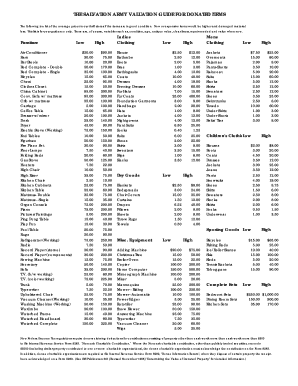

Non Cash Charitable Contributions/Donations Worksheet 2007-2026 free printable template

Fill out, sign, and share forms from a single PDF platform

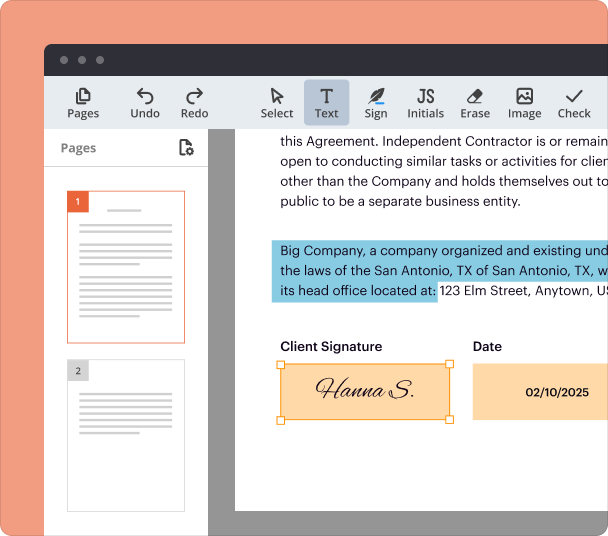

Edit and sign in one place

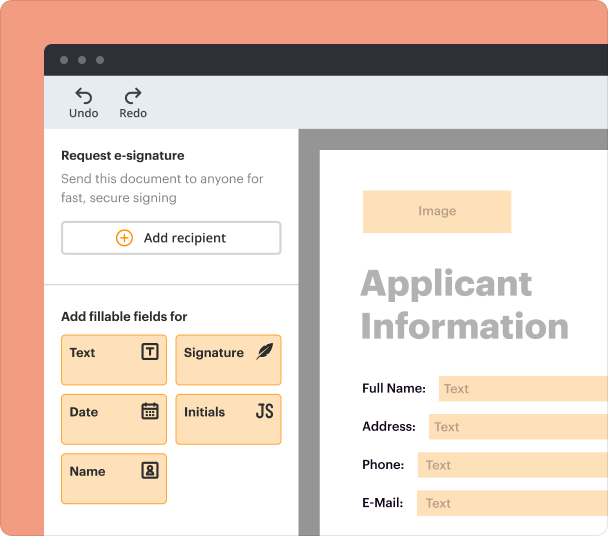

Create professional forms

Simplify data collection

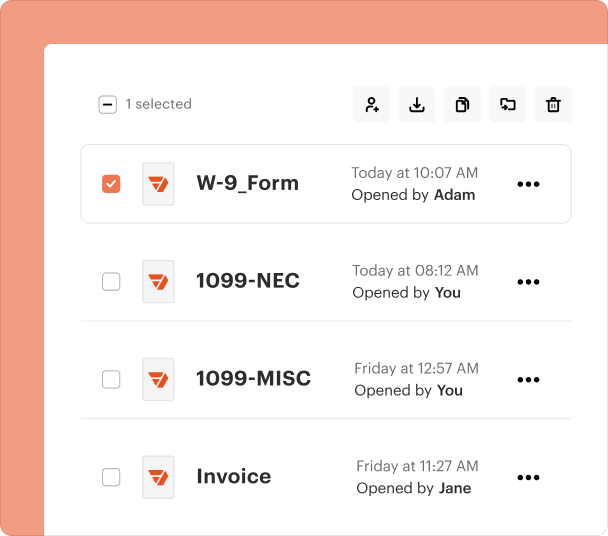

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Non-Cash Charitable Contributions Donations Form Guide

Learn how to accurately fill out a non-cash charitable contributions donations form to ensure compliance with IRS regulations and maximize your tax benefits.

What are non-cash charitable contributions?

Non-cash charitable contributions are donations made to qualified organizations that do not involve cash but rather physical items or services. These can include clothing, electronics, or furniture. Proper documentation is crucial for tax purposes, as the IRS requires detail on all donated items.

-

These contributions refer to donations of goods and services rather than cash.

-

Accurate records allow for proper deduction claims during tax filing.

-

Understanding IRS rules can prevent issues and ensure compliance.

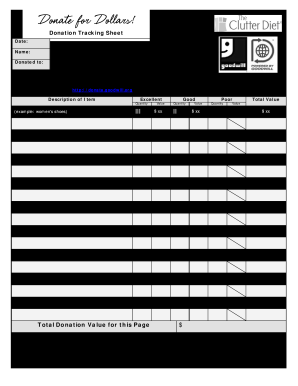

What is the non-cash charitable contributions donations worksheet?

The Non-Cash Charitable Contributions Donations Worksheet is a vital tool for streamlining the documentation process of your donations. This worksheet assists in accurately calculating the value of donated items, which is essential for tax deductions.

-

To document the details and enhance clarity around your donations.

-

It provides structure and reminders for necessary information to report.

-

Follow specific guidelines to ensure the worksheet remains useful for future reference.

How do you fill out the donations worksheet?

Filling out the donations worksheet can feel daunting, but breaking it down into manageable steps simplifies the process. Each field requires specific information that must be accurate to ensure compliance.

-

Choose the correct tax year for which your donation applies.

-

Ensure your name is spelled correctly according to tax documents.

-

Document the exact date of donation for tracking purposes.

-

Identify the organization and ensure it qualifies as a charity.

-

Determine value based on authoritative guides to avoid IRS disputes.

How can you categorize your donations?

Categorizing your donations is essential for maintaining clarity and ensuring that you've documented all contributions correctly. This organization facilitates the valuation and tax reporting process.

-

Include detailed categories such as blouses, dresses, etc.

-

Include categories including jackets, suits, etc.

-

Items such as shoes, and jackets belong here.

-

Electronics, furniture, and collectibles should also be listed.

What are the valuation guidelines for non-cash donations?

Valuation of donated items is one of the most critical aspects of documenting non-cash charitable contributions. Failing to assess the value correctly can lead to challenges from the IRS.

-

Assess items based on their condition, which affects the valuation.

-

This guide can help you determine what similar items are worth.

-

Accurate valuation can help mitigate disputes in case of audits.

-

Receipts serve as proof of donation, essential for tax purposes.

What common mistakes should you avoid?

Being aware of common mistakes can significantly enhance the success of your non-cash charitable contributions claims. By proactively avoiding these errors, you protect your donations and ensure compliance.

-

Always record each item individually to maintain clarity.

-

Descriptions help substantiate the value and legitimacy of your donations.

-

Use established guidelines to assess value correctly.

-

Adhering to IRS rules prevents potential issues during audits.

What tips can maximize your charitable contributions?

Maximizing your non-cash charitable contributions involves strategic planning and execution. These tips can help you maximize your tax benefits while engaging effectively with donors.

-

Collecting items in bulk can streamline the donation process.

-

Providing clear instructions simplifies the donation process.

-

Utilize pdfFiller's tools to enhance your documentation efficiency.

-

Many resources are available to ensure adherence to IRS rules.

What are interactive tools for document management?

Employing interactive tools can greatly enhance your experience when managing documents related to charitable donations. pdfFiller offers a variety of features for document management.

-

Easily modify and sign documents anywhere you are.

-

Effectively work with others to streamline the donation record process.

-

Access your donation documents at any time from any device.

-

Ensure your documents meet necessary legal standards effortlessly.

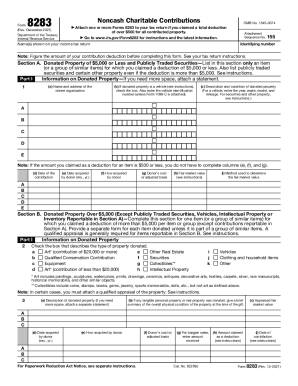

How to ensure compliance with IRS regulations?

Compliance with IRS regulations is essential when reporting non-cash charitable contributions. Understanding the specific requirements can help avoid complications during tax season.

-

Form 8283 is necessary for values exceeding $500; fill it accurately.

-

Detailed records and proofs are needed for tax deductions.

-

Higher value items may require a qualified appraisal.

-

Many online tools can provide guidance and updates on tax laws.

Frequently Asked Questions about donation value guide irs form

What are non-cash charitable contributions?

Non-cash charitable contributions refer to donations of goods or services instead of money, such as clothing, household items, or electronics. They play a crucial role in charity work and can also offer tax benefits.

How do I fill out the non-cash contributions donations form?

To complete the form, follow structured steps like entering the tax year, taxpayer's name, date of donation, and valuing your goods correctly. Accurate documentation is essential for it to hold up during audits.

Why is the valuation of donated items important?

Valuation is vital because it directly affects the deductions you can claim on your taxes. Incorrect valuations can trigger audits or disallowed deductions.

What common mistakes should I avoid when documenting donations?

You should avoid failing to document each item separately, not providing accurate descriptions, and ignoring IRS substantiation requirements. Keeping a detailed record can protect you during any tax audit.

How can I maximize my non-cash charitable contributions?

To maximize benefits, consider donating in bulk, understanding IRS guidelines, and using tools like pdfFiller to manage documentation and valuation. Clear communication with donors can also help ensure efficiency.

pdfFiller scores top ratings on review platforms