Who needs a Non Cash Charitable Contributions/Donations Worksheet?

A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from the tax return.

What is Non Cash Charitable Contributions/Donations Worksheet for?

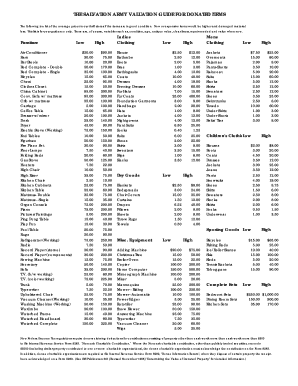

The Salvation Army Donation Guide Spreadsheet is helpful in terms of calculating the cash equivalent of the goods donated so that this amount can be reported as a desired tax write-off. The form lists the average prices of all the possible goods and the approximate amount that can be paid for certain items at thrift stores.

Is Non Cash Charitable Contributions/Donations Worksheet accompanied by other forms?

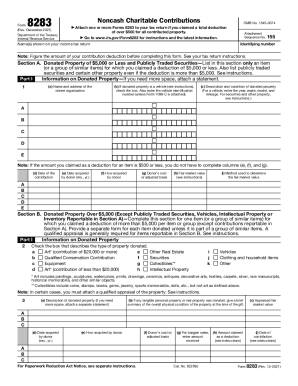

It is highly recommended that a Contributions/Donations Worksheet be accompanied by receipts that are given to contributors when they bring goods they want to donate. Logically, the completed form should be kept together with the rest of tax files. When the deductions a contributor wants to claim exceed $500, they should also file the IRS Form 8283.

When is Non Cash Charitable Contributions/Donations Worksheet due?

The Salvation Army Donation Value Guide should be referred to and the 8283 Form (if applicable) should be submitted when the contributor is filing their yearly tax return.

How do I fill out Non-Cash Charitable Contributions/Donations Worksheet?

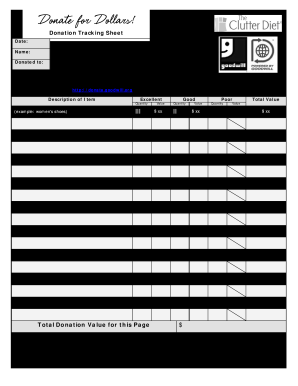

Broadly put, the worksheet form is a table which requires indicating the taxpayer, the done, the year reported on, and the date.

Where do I send Non-Cash Charitable Contributions/Donations Worksheet?

There is no need to send the worksheet anywhere, as it serves only a tool to calculate the contributions/donations.